As employers plan their 2025 benefits strategy, attracting and retaining talent and managing costs will both continue to be factors. The rise in healthcare costs means health plan sponsors will need to optimize their benefits plans to continue to be able to invest in attraction and retention. Over the last several years, the job market has been increasingly competitive and a key challenge facing many employers was how to attract and retain talent. To do so, many employers offered more attractive benefits packages to their people. In the last year, the gap has narrowed between plan sponsors that rank attracting and retaining talent as the top priority in making benefits decisions and those who rank reducing costs as the top priority. Broad economic factors, including healthcare costs, inflation, global economic uncertainty have shifted employers’ focus. And healthcare cost is expected to rise again next year, under current market conditions, at an average rate of 6 to 8%. The 2024 Lockton National Benefits Survey data shows that while attracting and retaining talent is still highly important for plan sponsors, many employers indicated a competing priority — optimizing the cost of their benefits plan. The 2024 Lockton National Benefits Survey features responses from 1,611 employers across the U.S. The employers represent a variety of industries, group sizes and ownership structures. Their responses reflect their different philosophies on how to attract and retain talent while managing the cost of their health and welfare benefits.

Here is the Insights Report

0 Comments

A class action lawsuit was just filed against drug manufacturer Johnson & Johnson (J&J) in its capacity as an employer and plan sponsor. The suit alleges that J&J breached its fiduciary duties by not taking proper measures to ensure its plan costs were reasonable as well as failing to exercise prudence in selecting its pharmacy benefit manager (PBM) and agreeing to undesirable contract terms. Specifically, the suit accuses J&J of mismanaging its employees’ drug benefits, resulting in employees significantly overpaying for certain drugs. This lawsuit is an example of the recent uptick in impending lawsuits regarding compliance with recent transparency rules, reinforcing the need for ERISA fiduciary governance. To help navigate these responsibilities, Lockton held webcast that walked through the key steps of proper fiduciary governance for employers. Click here for a replay of the webcast We have also created a Fiduciary Governance Toolkit to help ensure clients are well-versed on and are meeting their fiduciary duties. The Lockton Fiduciary Governance Toolkit includes:

If you have questions or would like to speak with one of Lockton's Compliance attorneys, please reach out at [email protected] or 617-840-4515  On February 15th, NEEBC orchestrated the region's first-ever employer focused Oncology Symposium, hosted at the Dana-Farber Cancer Institute in their Jimmy Fund Auditorium. The sold out event provided employers actionable insights to promote early detection and treatment, reduce oncology costs and how to best support employees, families and caregivers on their cancer journeys. Leading experts discussed how organizations navigate the complex world of oncology care and focus on the ever-evolving world of oncology benefits:

As cancer rates continue to rise, it’s important to remember that employees are increasingly concerned about cancer. This event was a learning opportunity for employers to increase understanding so that they can make a difference in cancer care for their workforce. Some of the survey feedback on the event was:

Some key takeaways for the Symposium are

The Critical Importance of Early Detection in Cancer Treatment The discussion underscored the stark difference in survivability rates between early and late-stage cancer diagnoses, highlighting colon cancer as a case study where Stage 1 survival rates are at 91%, compared to only 13-14% for Stage 4. The panel noted that currently, only four types of cancers have approved and reliable screenings (colon, breast, cervical, and lung), leaving a significant gap as 72% of cancers do not have early detection tests. Further discussion centered on emerging technologies, like DNA-based blood and urine tests, that aim to fill this gap, offering hope for early detection across more types of cancer. The discussion around the FDA's breakthrough designation for Grail and the focus on high specificity to reduce false positives in testing are part of the efforts to improve early detection. The February sun was shining, temperatures in the mid-forties as I arrived at the Hanover Inn. Back in town for the 2024 Tuck Center for Private Equity and Venture Capital Conference. My midday arrival allowed me to take a few laps around Occum Pond and the campus. Sadly, most of the snow had melted and the prospects for Carnival ice sculptures were dim. I’m sure the students were ready to revel in their long winter weekend. I know I did “back in the day”. The conference kicked off with a reception and dinner at The Inn featuring an hour-long interview of Silver Lake Partners co-founder, Jim Davidson, by Tuck Dean, Matthew Slaughter. Jim was a last-minute pinch hit and I thoroughly enjoyed the interview and discussion which included topics such as

The business case for using artificial intelligence (AI) technologies in health and benefits is slowly emerging based on the potential to create improved healthcare experiences, enhanced analytics, drive administrative efficiencies, and improve employee and clinician decision-making. To better understand the application of AI in health and benefits, we start with some fundamental questions about whether this technology is truly intelligence or just a probabilistic machine making predictions about the next most likely action. Lockton helps navigate several potential use cases for various types of AI technologies and how it will affect health and benefits in our October 2023 whitepaper Blue Shield of CA has a new PBM prescription for their 4.8M members – “flipping that (the current pharmacy supply chain) on its head.” according to CEO Paul Markovich.

The health insurer announced a move away from CVS as their PBM and is instead replacing it with multiple partners:

In a recent interview with The Wall Street Journal, Blue Shield's CEO, Paul Markovich, highlighted the challenges within the current pharmacy supply chain, characterizing it as a complex and opaque structure designed to maximize profits for its participants. “The current pharmacy supply chain is a forest of opacity and profit,” said Paul Markovich, Blue Shield’s chief executive officer “It is overwhelmingly complex, it is designed to maximize the earnings of the participants.” His company’s new setup, he said, will be “flipping that on its head.” Blue Shield has unveiled a groundbreaking initiative that aims to bring greater transparency and efficiency to their pharmacy benefit management strategy. Key highlights of Blue Shield's new setup include:

Why would Blue CA move this direction? By breaking apart the components, the new approach can provide more transparency into the cost of each part of the pharmacy benefit. Wall Street analysts don’t believe other large organizations will follow suit in the short term but will be watching closely to see if the new decentralized approach can be executed appropriately and is delivering on the projected savings. What could this mean for employers? It will be difficult for most employers to replicate this exact model. However, some smaller PBMs have taken the approach to outsource different components themselves. For example, they may own the adjudication platform but outsource the network, rebates, and specialty pharmacy. Some employers like this model as they believe the costs are more transparent and it reduces conflicts of interest between the PBM and the plan sponsor. Lockton Pharmacy Point of View: We are generally supportive of this approach and have implemented similar structures / components with some health plans clients. By breaking up the sole PBM, there is greater transparency for the cost associated with each component of the pharmacy benefit. Employers can select the best of each vendor to perform these functions. This strategy more likely to be effective for larger, more forward leaning groups. We don't see it working for smaller clients (at least not for right now). Some operational questions

Adam Fein wrote a great article on this move on his Drug Channels blog "A Reality Check on That Blue Shield of California Announcement"

Watch Part 1 and Part 2 of our videos to learn... What's Really Driving Employer Health Plan Costs?

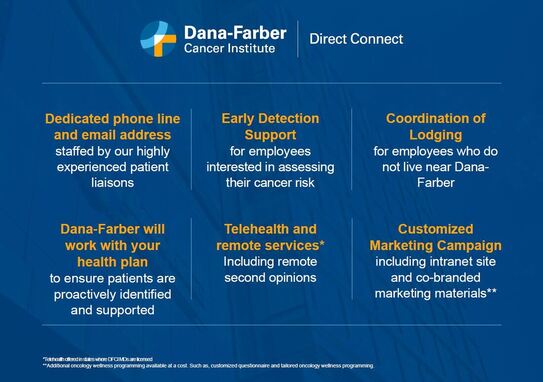

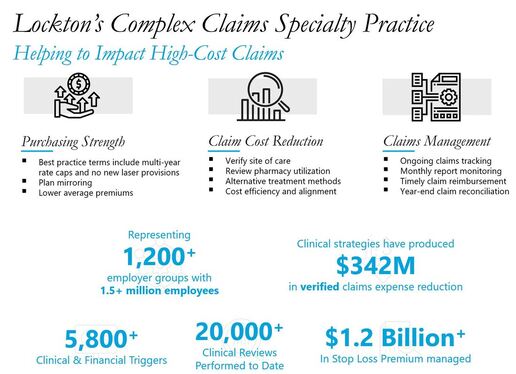

According to the National Cancer Institute, 39.5% of men and women will be diagnosed with cancer at some point during their lifetimes. The uptick in cancer rates nationwide is one of the reasons why Lockton partners with Dana-Farber to help manage access, treatment, patient / family support and costs of cancer. On June 20th, we will present the details of how we're teaming up to fight cancer. Dana-Farber will review their employer focused programs and Lockton will lay out our Complex Claims / Centers of Distinction approach for self-funded companies. Meeting will be held from 12:00 to 2:00pm. Lunch will be provided and a parking voucher will be available. A tour of Dana-Farber will take place following the meeting for those interested. Location - 44 Binney St, Boston, Massachusetts 02115 Guests will learn about Dana-Farber's Direct Connect Program. Designed for employers, Dana-Farber Direct Connect is a free direct access and navigation program that improves access to our worldleading oncologists and specialized care. Lockton will present our Complex Claims Specialty and Centers of Distinction for self-funded clients. These services include

Lockton has established streamlined direct referral relationships with some of the country's top institutions including Dana-Farber, Cleveland Clinic and Mayo Clinic to facilitate reviews of cases where members appear to be having difficulty getting the right diagnoses and/or best-fit treatment recommendations. To learn more or register for our event, please email [email protected]

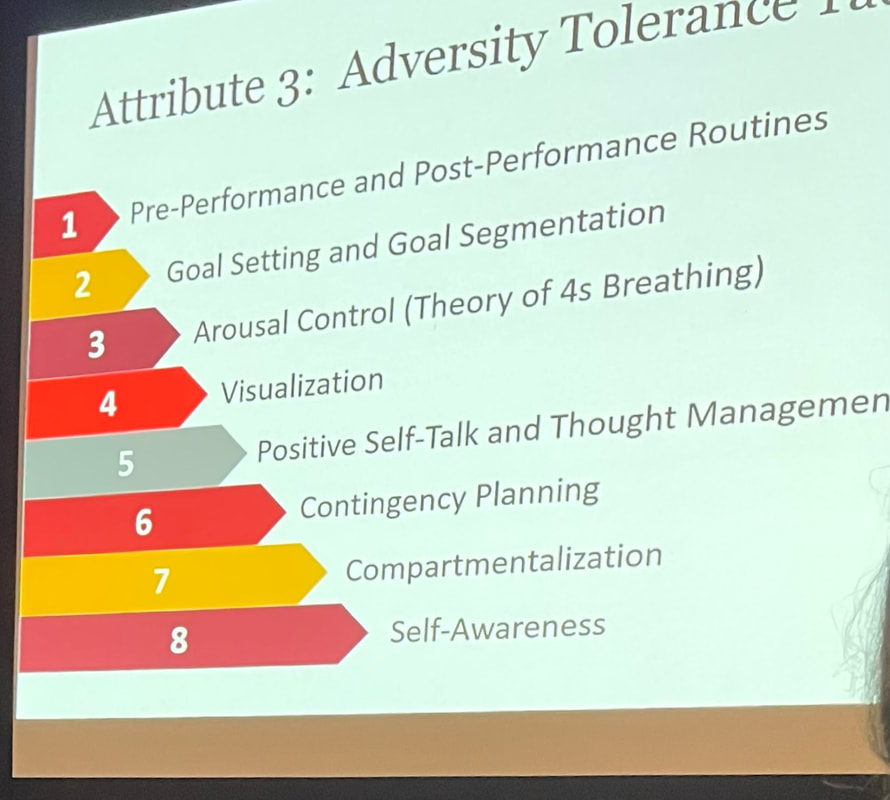

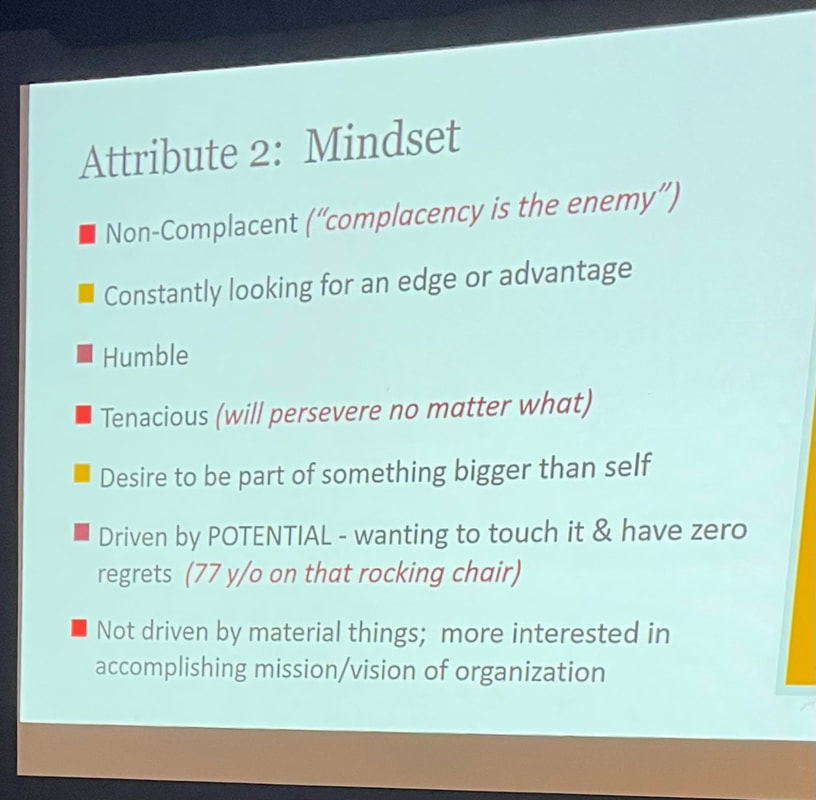

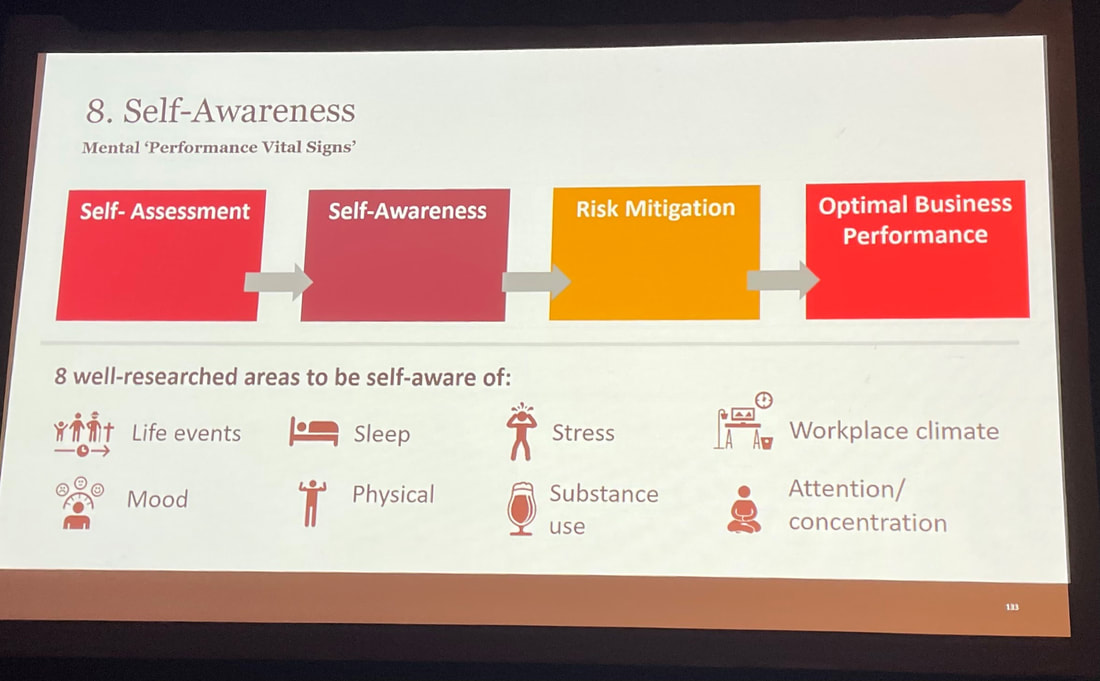

Mental health and emotional well-being were consistent themes throughout Lockton’s 2023 Global Benefits Forum hosted in San Diego. We kicked off Day 1 with a terrific keynote speaker, Eric Potterat, Ph.D., who addressed us on “Learned Excellence: The Key Performance Optimization Factors of High Performing Individuals and Teams”. The key traits he presented (Grit, Mindset, Adversity Tolerance and Balance / Recovery) will help me. Eric knows a thing or 2 about high performance having spent his career helping elite organizations—from the Navy SEALS to the World Series Champion Los Angeles Dodgers—develop the personal traits that drive elite performance. Eric has also worked with hundreds of business executives, NASA, firefighting organizations, and world-class athletes from every sport, including gold medalist Nathan Chen and the U.S. Women’s Soccer team. He began by asking us, “What is mental toughness?” It seems like a simple question—until we try to define it. He explained that even though we all know mental toughness when we see it (pictures of super achievers and heroes like Sully Sullenberger flashed on the screen), we can’t always explain what it is. Pressed to define it, most of us will describe mental toughness as poise under pressure, stress tolerance, or the ability to limit distractions and stay confident and composed. The reality is those are all end states. And with life now in a state of uncertainty, the question now becomes, how do we reach those end states and stay there? The key traits shared by all high performers are Grit, Mindset, Adversity Tolerance, and Balance / Recovery For each trait, he explained the science and insights that make them such important differentiators and then synthesized the core of each trait with clear takeaways. How to increase your Grit? “The foundation of becoming grittier is working outside of your comfort bubble.” In other words, get comfortable being uncomfortable. When we identify true motivators, and determine our passions / purpose, we are orders of magnitude closer to meeting our goals. Key attributes include the ability to delay gratification as well as see setbacks as opportunities. What does having a growth Mindset really look like? “The hallmark of elite performers is a thirst for useful feedback.” Carl Dweck defined for the world a Growth vs. Fixed Mindset. Folks with Growth Mindsets see challenges vs. threats and obstacles / setbacks as a chance to learn, stretch and grow. In speaking about Adversity Tolerance, Eric highlighted the fact that the most foundational aspect of these elite performers — their ability to stay cool and focused in high-stress moments — is not hereditary; it’s learned. The best-of-the-best performers focus on their mindset during high-stress moments because it’s dead-center within their sphere of control. “The rest is outside of your control. So, try to stay in that circle. The elite performers are focusing where they can affect change” Attitude, effort and action are the only 3 things humans can control 100% of the time. And why is it important to make sure your relationships, your health, and the other pillars of your life are strong and in Balance? “The beach house with the most pillars is going to withstand the storm.” There are different mindsets for different roles. Imagine bringing the tenacity of a competitive athlete when interacting with our family, friends and communities. “The healthiest and best performers are able to separate WHO they are from WHAT THEY DO.” There is promising work and research being done regarding resilience accelerators including drinking tart cherry juice to promote deeper sleep and brain neuroplasticity, float / sensory deprivation tanks, metadata and physiology / surveillance apps and “forest bathing” i.e., go for a walk in nature.

Eric’s work is proprietary and he’s finishing an upcoming book covering the core aspects of elite performance and it is expected in early 2024. I can't wait to read it. |

AuthorMike Smith - trying to put my history degree to good use through research and writing . Mom would be proud but she still wanted me to study business. CategoriesArchives

June 2024

Categories |

RSS Feed

RSS Feed