|

Blue Shield of CA has a new PBM prescription for their 4.8M members – “flipping that (the current pharmacy supply chain) on its head.” according to CEO Paul Markovich.

The health insurer announced a move away from CVS as their PBM and is instead replacing it with multiple partners:

In a recent interview with The Wall Street Journal, Blue Shield's CEO, Paul Markovich, highlighted the challenges within the current pharmacy supply chain, characterizing it as a complex and opaque structure designed to maximize profits for its participants. “The current pharmacy supply chain is a forest of opacity and profit,” said Paul Markovich, Blue Shield’s chief executive officer “It is overwhelmingly complex, it is designed to maximize the earnings of the participants.” His company’s new setup, he said, will be “flipping that on its head.” Blue Shield has unveiled a groundbreaking initiative that aims to bring greater transparency and efficiency to their pharmacy benefit management strategy. Key highlights of Blue Shield's new setup include:

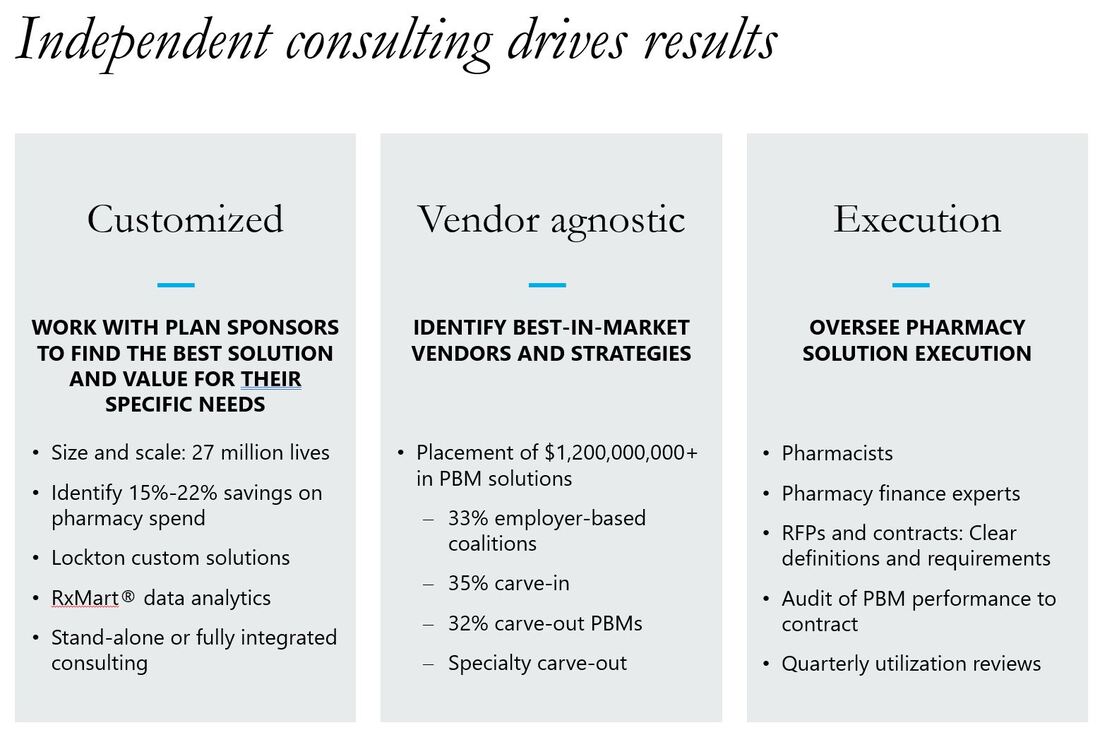

Why would Blue CA move this direction? By breaking apart the components, the new approach can provide more transparency into the cost of each part of the pharmacy benefit. Wall Street analysts don’t believe other large organizations will follow suit in the short term but will be watching closely to see if the new decentralized approach can be executed appropriately and is delivering on the projected savings. What could this mean for employers? It will be difficult for most employers to replicate this exact model. However, some smaller PBMs have taken the approach to outsource different components themselves. For example, they may own the adjudication platform but outsource the network, rebates, and specialty pharmacy. Some employers like this model as they believe the costs are more transparent and it reduces conflicts of interest between the PBM and the plan sponsor. Lockton Pharmacy Point of View: We are generally supportive of this approach and have implemented similar structures / components with some health plans clients. By breaking up the sole PBM, there is greater transparency for the cost associated with each component of the pharmacy benefit. Employers can select the best of each vendor to perform these functions. This strategy more likely to be effective for larger, more forward leaning groups. We don't see it working for smaller clients (at least not for right now). Some operational questions

Adam Fein wrote a great article on this move on his Drug Channels blog "A Reality Check on That Blue Shield of California Announcement"

0 Comments

|

AuthorMike Smith - trying to put my history degree to good use through research and writing . Mom would be proud but she still wanted me to study business. CategoriesArchives

June 2024

Categories |

RSS Feed

RSS Feed