|

“In times of crisis, everyone has a part to play. You cannot live your life just for you. You are part of a whole. You are part of a community and you must do your part.” Mel Brooks - Actor, Author, Comedian, Producer and Veteran of WWII

On Wednesday afternoon, April 8th, 10 global employers joined Lockton consultants on a virtual WebEx meeting to discuss the unique challenges of managing global benefits during these hectic times. Several concerns were shared as well as the creative approaches and solutions implemented by these employers in the following areas

Safety and protection of employees, families and communities are paramount to employers. Many were well prepared from a technology standpoint with well thought out and implemented infrastructures, security protocols (Zoom’s issues are of an ongoing concern). The largest challenge surrounds care and education of children with day care and school systems shuttered during the crisis. Employees need to balance the requirements of work with the needs of their families. “I am now apparently running a daycare center as well as doing a full time job. I have a 2 year old boy, an 8 year old daughter and a 40-something husband with a 50+ hour a week job in software QA. My husband is doing his job remotely as well, so we spend our days switching off for whose turn it is to try to work in the living room while our son plays. I am a WFH veteran, having done full time WFH for my previous employer for 5 years, so I have a good home office set-up, however I have never had the kids home while I was trying to work. There is a lot of logging in after the children go to bed, after 9 PM. I very much miss my 8 AMs in the office as well as the lobby Starbucks at about 2 PM. I do not miss the T, however.” While virtual meetings and cloud infrastructures help, companies have introduced additional flexible work and leave programs spanning between two weeks to one month with usage in hourly increments. In most cases, these programs are used for managing both illness and the challenges of caring for and educating children while working from home. For employees who cannot work from home (healthcare, manufacturing, distribution, food services and other essential workers), employers have implemented shift rotations, increased as well as decreased shift hours, expanded work weeks. Employees are responding positively to employers who have supplemented their compensation, resources and benefits, including free or low-cost tools that they can access remotely (e.g., online children’s education resources, telehealth, etc.). This crisis is affording employers the opportunity to increase engagement as well as double down on communications. Of course, some employers are not willing or able to offer these enhanced services. Employers should weigh these risks when the economy opens back up as they may see increased turnover, higher costs and lower productivity.

Business and employees’ personal and work lives have suddenly and deeply been disrupted over the past few weeks. Many employers have ramped up communications across a multitude of channels (email, print, video, text, social media). These stresses are further complicated as many employers have had to implement furloughs, layoffs, reductions in work hours, reductions in compensation and benefits as well as suspensions of business in certain geographies. To help alleviate some of these stresses, many employers are ramping up their global EAPs which can provide significant value when fully deployed including webinars, counseling and other resources. There exist significant capacity constraints with EAPs who are not currently staffed nor are their business models architected to handle these sudden spikes in demand both at the employee and employer level. Some EAPs are implementing hotlines with limited scope to answer coverage and access questions related to COVID-19 as well as expanded mobile tools and web site blog support. We believe that EAPs will ramp investments in AI and chatbots through and after this crisis. “I have suddenly found myself implementing 4 global EAPs for clients and many others are considering implementation.” Lockton Global Benefits Associate

Employers are evaluating strategies across the entire total rewards spectrum to meet employee needs and achieve financial objectives. Additional services to enhance the member’s experience and offset member financial responsibility include telehealth and virtual mental health services. Global employers are finding a mixed bag to these services as local availability varies and no single provider offers telehealth to all local groups in multiple countries. Given increased internet access, aging demographics and rising healthcare costs, our employer panel agreed that pursuit and expansion of global telehealth is on their agendas. According to Optum’s April 2020 on employer sentiment, many employers are offering employees 24/7 mental health support (57% of survey respondents) while clinical services such as telemedicine with 24/7 support are offered at a lower rate (43% of survey respondents). Before the COVID-19 pandemic, both Bain and BCG weighed in on the expansion of telehealth and global technology usage to bolster healthcare. As late as February of 2020, Bain illustrated that according to US physicians… 17% were using telemedicine 40% weren’t using telemedicine but were planning to within the next 2 years 20% were using remote patient monitoring 35% weren’t using remote patient monitoring but were planning to within the next 2 years Given the relaxation of regulations regarding provider licensing and cross border practices / liability, we expect these utilization figures to jump substantially. Lockton is already seeing this increase in our clients’ utilization rates. In April of 2019, BCG “identified four high-priority opportunity areas in which AI tools could be scaled successfully and impactfully in low-resource contexts:

We are seeing a sudden proliferation of new Coronavirus-related insurance policies. Some of these are designed to supplement gaps in employer-provided private medical insurance plans and others are similar to hospital indemnity cash plans sold in the U.S. The need for such new policies will need to be evaluated in the context of an employer’s existing benefits package, on a country-by-country basis. We are also seeing the emergence private companies offering Coronavirus testing services. These have not always been approved by local health authorities, and their use by companies raises a number of issues which could have multiple implications. A well-intentioned employer looking to protect the safety of employees as we start to return to work could create unanticipated risk around data privacy, test reliability, and the recommendations of local health authorities. As employers prepare to return to work we anticipate that

Thank you to everyone who participated in Wednesday’s meet up. We aim to continue these virtual sessions in the coming weeks. Feedback is always welcome. If you are interested in attending our next session (targeting the week of April 27th) and could spread the word, that would be great. All with a stake in Global Benefits are welcome.

0 Comments

When I started this website in mid-2019, I had no idea the “Future of Work”, employee benefits, and our world would be so impacted by the global pandemic, COVID-19. My thoughts and focus were on the impact technologies such as automation, AI, mobile, robotics, digital biology, blockchain, global gigabit networks and others would exponentially grow and change the nature of work. Little did I think about or know how a global pandemic, an invisible enemy, would amplify the technology changes that are sprinting ahead. A week ago, I commuted to the office. I also worked from home, held meetings with clients, colleagues and partners, booked travel, planned for upcoming conferences, ate lunch at the restaurant in our lobby, held a budget meeting and was onboarding a new client. My older children were off at college, my youngest was more than halfway through Junior year in High School, my wife was managing the Westborough Girl Scout cookie sales program, and I was looking forward to spring, golf, volunteering, gardening, graduations and a whole host of other activities. This week I’m fighting for Wi-Fi bandwidth with three children doing online learning after being sent home from high school and college. My wife Pam and I are trying to figure out how to have five separate “home offices” for our family- three of whose lives have been uprooted from forces beyond their control. Through technology, we are better prepared to be more productive working from home with networks in the cloud, video meetings, social media tools. How many more times have you checked Facebook or LinkedIn in the past week? How many online meetings have you participated in? Played Zoom Bingo yet?  Chelsea Piers on Manhattan’s lower west side hosted CBInsights “Future of Health” conference On October 2nd and 3rd. Reviewing the agenda over a cup of coffee, it became clear that this event would highlight technology’s promise, threat and opportunities in healthcare fueled by an abundance of capital looking for a home. Why healthcare? Why not. Every aspect of our lives is being impacted through technology. As US healthcare spending approaches 20% of GDP, an aging global population and disparate access to healthcare, technology holds a promise to revolutionize health in this 4th Industrial Revolution. Walking the few blocks to the sessions, I thought about Peter Diamandis and his thesis on technology that it “(Technology) takes what is scarce and makes it abundant.” Countless examples come to mind whether it Moore’s Law and computational power / costs or the story of Napoleon III serving the King of Siam on Aluminum dinnerware (Aluminum was more valuable than gold or silver at the time and that’s why six pounds of it sits atop the Washington Monument) or the fact that laboratories can now produce flawless, harder diamonds than the Earth, coal and pressure can. Technology will democratize healthcare, providing broader access to services, lowering the costs, improving the quality and disrupting the current network in ways that we can see and even more that we likely cannot yet see. To deny these changes is burying your head in the sand.  Summer is winding down here in New England. The kids are back to school, the days are getting a little shorter and the commute to Boston is back to a familiar grind. At Lockton, we are working with clients; finalizing vendors, plan designs, rates, contributions, etc. In the build up to Open Enrollment and the 2020 plan year I thought a good post summer topic would be an ongoing challenge that all our clients are facing and how we might be able to help…Pharmacy Management. The pharmacy market is changing rapidly and at times might be difficult to follow. In July, in conjunction with NEEBC (New England Employee Benefits Council) we co-presented on this topic with one of our partners, RxBenefits. Hopefully, we shed some light on what’s happening and what it means to employers and their people. The impact of recent PBM/Carrier transactions will add even more complexity to an already complex market. As the PBM market consolidates (Cigna buying ExpressScripts, CVS buying Aetna, and United Health’s expansion of Optum Rx), disruption will occur as these companies convert clients, systems and deploy new solutions. Understanding and navigating these massive entities was already difficult prior to this consolidation. It will now require additional focus, scrutiny and oversight. They will also undoubtedly introduce new models which will require examination and due diligence as their value will only be proven out down the line. Of all healthcare spend, pharmacy is the most volatile as it’s expanding to become the fastest growing components of healthcare. In 2008, pharmacy represented 10% of total health spending. In 2018, it has swelled to 19%. The average gross cost per Rx was $72 in 2008 and in 2018, was $126 (75% increase) and Rx costs per member per month (PMPM) also increased by 75% from $66 PMPM in 2008 to $116 PMPM in 2018.  3 months of bad skiing Since this season can be fleeting, I thought for July and August, my readers might enjoy some Lockton curated content for light summer reading and I would enjoy the weather. Therefore, I give to you the 2019 Lockton Benefits Survey – Executive Summary. A best seller since April! Inside, you’ll discover quite a bit including these 3 key takeaways…

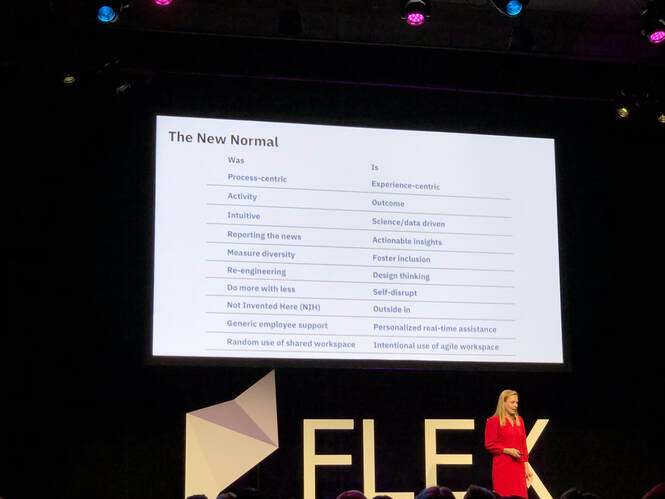

If you’d like more information including the full findings of our survey, please reach out and we’ll get them out to you. See you in September!  Last week, I sent an Outlook invitation to a client’s Head of People and her team for our standing QBR (Quarterly Business Review) meeting. I received this response, “We’re just too busy with Recruiting right now to meet. It’s all hands-on deck with my team. Let’s push to late summer / September.” These QBR’s are part of our standard client delivery methodology and are events in which clients find a lot of insight and value, so I was surprised. But maybe I shouldn’t have been. You’d have to be trapped under a rock or stranded on a deserted island to not realize that unemployment rates are at historic lows and competition for talent is fierce. Here in Massachusetts these pressures are among the highest in the nation. What happened next was even more surprising! It happened again…with another client…with the same issue, “We’re too busy with hiring talent right now. Let’s skip to Q3”. This made me start wondering what specifically these clients were dealing with, and I found some answers at a pair of conference sessions. I was scheduled to attend an upcoming breakfast seminar on the topic of hiring entitled, “How to Hire Talent in a Tight Labor Market” sponsored by Broadreach Staffing Solutions. Timing was great and so was the content. Right off the bat, it became clear that organizations today must handle a more complex mix of business requirements as well as requisitions which are highly specialized and, in many cases, unfamiliar to the recruiting teams. For instance, 20% of current requisitions are for roles with which the recruiters are unfamiliar, and it takes 38% longer to fill these unfamiliar roles. In addition, 58% of the heads of recruiting have difficulty acquiring the talent to maintain the current business and 64% of the heads of recruiting are having difficulty acquiring the talent to support a change in strategy. And finally, specialization is the name of the game where 71% of organizations recruit for more specialized roles than they did five years ago. I next had the opportunity to attend the Flex Summit sponsored by Fuze here in Boston. It was a great experience focused on engaging in the future of flexible work. The closing speaker that afternoon was Liz Kiehner of IBM who spoke about how their clients are digitizing the workforce. I wrote about IBM’s success and investment in recruitment digitization as well as optimization back in my March blog (“HR recruits AI”).  “It’s a small world…I wouldn’t want to paint it.” I still laugh thinking about Stephen Wright’s deadpan delivery of this classic one-liner. Returning from Lockton’s Global Benefits Forum, my head was still spinning from all the great content that was delivered at these sessions in Chicago (more on that content at the end of this blog). During the sessions, at breaks and meals, clients kept sharing that while the world may be small in Stephen Wright’s view, it is growing immensely complex regarding Human Resources and employee benefits. Global growth is accelerating and as markets, clients and competitors expand, employers are having to meet their constituents where they are. Increasingly, they are meeting them outside the United States. It would be nigh on impossible for me to sum up all the content of this forum in a short blog, however, I saw 2 major themes echo over the few days which center on the changes to the world’s demographics…

The world is aging incredibly fast and this aging is reshaping the global workforce. By the end of the 21st century, the populations of the Americas, Europe and Oceania will remain relatively flat while the populations of Asia and Africa will continue to rise. The African population will see the largest increase and by the end of the century, it should be roughly the same size as Asia. Nigeria will be the world’s 3rd most populous nation behind India (#1) and China (#2). These shifts will set up 3 stratifications of a) lower income nations / geographies, b) middle-income nations / geographies and c) higher income nations / geographies.  At a recent seminar sponsored by Prudential, Paul Braihm, CFP of The American College, detailed the challenges of declining US productivity and its main culprit – financial stress by employees that occupy their waking (not just working) hours. With talent at an all-time premium and unemployment rates at historic lows, employers are concerned with making sure their people are healthy, mindful, present, engaged and productive at work. Dr. Steven Covey, Guru of Productivity, said “Having spent my career helping individuals and corporations increase productivity, I’ve become convinced that one of the greatest, unnoticed drains on individual productivity is the distraction that financial stress puts on people.” These stressors affect people at all levels of organizations including the “Highly Compensated”. All employees can be affected and therefore, all employers can and should provide help. A January 2019 State Income & Policy Report from non-profit ProsperityNOW showed that 43.3% of Massachusetts households did not have emergency savings, 49.2% of renters are “cost burdened” and 9.3% of adults could not see a doctor due to cost despite the lowest uninsured rates in the nation. Financial stress at work costs employers a lot of money in terms of absenteeism, tardiness, presenteeism, poor health, lower pay satisfaction, higher turnover, lower employee morale, accidents, theft, substance abuse and loss of customers. However, there is an undiagnosed and growing crisis brewing in delayed retirement.  On April 4th, Lockton sponsored an evening of stimulating conversation amongst Global Benefits colleagues featuring fabulous food and drinks with stunning views of Boston Harbor. Our event started with an hour of engaging peer to peer conversations and then we settled in for dinner. Nick Dobelbower, Lockton’s guru of Global Benefits, led a structured discussion on the latest Brexit issues as well as developing Gender & Diversity issues for US Multinationals. Regarding Brexit, Nick and his colleague, Selima Crum, authored a prescient article in last March’s issue of benefits magazine assessing the impact of Brexit for US firms focusing on European business, their regional talent strategy and employee benefit plans. A link to that article can be found here  On the last day of the recent WorkHuman conference, 3,000 attendees were buzzing with excitement waiting for Brené Brown (https://brenebrown.com) to take the stage as the closing speaker. The WorkHuman conference attendance has swelled in recent years, and with speakers like Brown, it’s no surprise. The content for those charged with leading people functions at employers is superb. It’s a bucket list event if you’re in Human Resources. Brené spoke of leadership and how future leaders need courage. To be courageous, she believes you need to be vulnerable. Whether she’s talking to Special Forces units, top global athletes or rooms full of school teachers, when she asks the question, “have you ever witnessed an act of courage without vulnerability?” the reply is always – No. The world is changing fast and we need to be vulnerable enough to say we haven’t got it all worked out. |

RSS Feed

RSS Feed